Paypal says the account is limited. Is your PayPal account restricted? Check out our detailed unlocking guide. PayPal needs to collect additional information about you. What does it mean

The Paypal payment system has long earned a reputation as a reliable and secure environment in which users do not have to worry about losing their money. However, like any tool, this system has its own nuances that need to be taken into account. One of these nuances in the case of PayPal is the automatic blocking of the account, called a “restriction” in the system. Let's figure out what it is.

What does the message "Your account is limited" mean?

The system sends the following notification to users who have received this “blocking”:Your account has been limited and you can no longer send or receive money through paypal. To remove this restriction, in accordance with Russian law, you must provide your passport information. Go to the Resolution Center and follow the instructions.

Thus, limiting an account only means that certain operations will not be available to the user for a certain reason; the account itself is not deleted or blocked in the usual sense of the word. As a rule, in personal account the reason for the restriction is indicated and how the service offers to remove it.

Why does PayPal restrict user accounts?

Paypal is an international financial system with an impressive turnover, which, of course, attracts scammers and other dishonest people. In order to protect against them, the service actively identifies and suppresses dubious transactions. And sometimes even the most ordinary transaction, such as a purchase in an online store, which subsequently leads to account restrictions, can fall under the concept of “doubtful”.The user can always find out the reason for limiting the account in his personal account on the website, but the most common options are as follows:

- an outsider could have used the account;

- the bank reported to Paypal about an illegal transaction involving the linked bank account or card;

- the account violated the laws of its country;

- the user did not comply with the Acceptable Use Policy;

- the user’s bad reputation as a seller - there are many returns, claims (stamps or disputes) hanging on him.

PayPal needs to collect additional information about you. What does it mean?

Pursuant to Section 4 of the PayPal User Agreement, the company has the right to request from users any information it deems necessary to verify the user. Naturally, first of all we are talking about an internal Russian passport (or a document replacing it), but the service can also request INN, SNILS, and other documents.The service may also ask you to provide documents confirming the purity of transactions - account statements, receipts, etc. All requirements for necessary documents will be specified in the notice of reasons for the restriction.

How to contact PayPal Resolution Center?

To clarify the nuances of account restrictions, the user can contact the Paypal Problem Resolution Center, which will explain the reasons for the “blocking” and further steps to remove the restrictions.This can be done by following the link and clicking on an open “case” from Paypal, which explains in detail what the user should do next.

Also, in some cases, such problems can be resolved with PayPal over the phone, but this is not always possible. The Paypal phone number, as well as calling instructions, can be found on the “Contact Us” page.

What should I do to avoid account restrictions?

In order for your transactions to remain “clean” from the point of view of the PayPal service, you need to observe banal “digital hygiene”: do not open dubious links asking you to enter data from your online banking or Paypal accounts. This also includes the common-sense requirement to periodically change the password for these same accounts.Sellers using Paypal as a payment acceptance tool should not sell items that require special permission (medicines, firearms, etc.) unless one is available. Failure to comply with Russian laws and Paypal policies may result in account restrictions.

Sellers should also monitor their reputation: try to deliver their goods on time, describe them as accurately as possible, and be responsible. Of course, one or two random complaints from buyers will not ruin the reputation, but a constant stream of disputes will eventually affect the seller’s account.

When registering in the PayPal system, each participant must familiarize themselves with the user agreement, PayPal's acceptable use policy, and other documents governing the relationship of both system users with each other and the user with the service. Careful study of these documents, and compliance with the rules and regulations described there, in most cases is sufficient to ensure that the account is never subject to restrictions.

Previously, the blog published an article about fraud by sending phishing emails on behalf of PayPal or other payment systems. But situations arise when, regardless of whether the card is verified or not, the user may receive a notification about limited access to PayPal. That is, Limited account access.

What is this connected with? Perhaps the user aroused certain suspicions from the security service or the necessary documents were missing, so the capabilities in the PayPal system were reviewed.

In most cases, we apply restrictions to your PayPal account for your protection. For example, the account may be restricted until you can confirm that the transaction is authorized by you.

As a rule, the following sanctions are imposed:

- Restrictions on sending payments.

- Restrictions on accepting payments.

- Limitation of the ability to close your own PayPal account.

- Limiting the viewing of account statistics.

This is standard security operation and applies even to experienced users.

The letter has been received. How to remove restrictions from PayPal?

First of all, the email must be checked for fraud. If the notification is indeed from PayPal, then the first thing you need to do is log into your account using your unique login information (username and password). Then follow the “Resolution Center” link and click “Why is my account limited” (Limited Account Access).

The reasons for blocking may be different and the order of subsequent user actions depends on them. Often, access to an account is limited due to lack of necessary documents. So, what needs to be done to remove the limit imposed by the security service?

Step #1. Prepare the necessary copies of documents confirming the user’s identity and address. The list of copies of documents is as follows:

- Copy of passport (foreign or internal passport).

- Utility Bills are copies of bank accounts (utility bills, telephone bills, Internet bills, etc.). In addition to mobile communications.

- Bank statements, card statements indicating your full name and address (the address must match the one specified during registration). A few payment documents are quite enough.

Step #2. Upload (or fax) copies of documents directly to PayPal.

If copies are sent via fax, then it is worth considering a number of transmission features. First, you need to print and fill out the page Cover Page– it is provided by PayPal. This is required for security purposes. When faxing documents, this page is sent first - it is the direct identifier. You can get a link to this page on the PayPal website: Resolution Center - Limited Account Access - Faxing

English terms and their meaning:

- Pages - the number of pages required for sending, including the first - Cover Page.

- Phone — contact phone number

- Enter a new email if the one listed is outdated - new email address, if the one specified during registration does not work.

- Comments - comments. In this paragraph you need to specify a list of copies of documents to be sent. You can also write Additional information, which is worth attention.

If it is difficult to send by traditional fax, then there are a number of well-known and proven services for sending fax messages. Also, many post offices offer the service “sending a fax abroad”.

Step #3. PayPal security service reviews received copies of documents within 3-5 business days (sometimes more).

Two possible answers:

- Restrictions have been lifted.

- Insufficient data (additional documents must be sent).

If you have completed the suggested actions, but restrictions have not been removed from your account, this means one of the following options:

— We have sent you an email requesting additional information, or;

- We will review the information you provide and will send you an email with the new information (usually within 3 business days).

IMPORTANT! PayPal sets the transaction limit on an account purely individually, based on the information received from the user. From this follows the template phrase of the security service - “Based on the information you provide, we will determine your Sending Limit.”

Each payment system has its own limitations and features. Knowing in advance what PayPal mistakes you can make , you can quickly solve the problem. We recommend that you study in detail how to increase PayPal limits and choose the level you need.

Features of limits

The Raupal system, operating in 190 countries, allows you to pay for goods, accept, withdraw and transfer funds. However, the size of monetary transactions is limited. During registration, an account limit is set, depending on the amount of information provided. The limit is the same for everyone, regardless of country of residence.

After initial registration, each New user receives the status “Not verified”. The limiter allows you to perform minimal operations on your account. The limit changes only after joining the system with a bank card, account and providing personal data.

Established restrictions:

- Anonymous client. A user who does not provide the requested information and does not attach a card cannot receive transfers and withdraw funds. The amount of a one-time transaction does not exceed 15,000 rubles. An anonymous client is able to perform actions for only 40,000 rubles per month. The capabilities of such a user are minimal; it is recommended to immediately provide information to remove the limits.

- Personalized account. After registration according to a simplified scheme, some restrictions are lifted. A personalized account allows the client to send 60,000 rubles at a time. It also becomes possible to receive transfers and withdraw funds to a connected bank account or card. A user can perform transactions worth 200,000 rubles in a month.

- Verified account. If the user wishes to further increase the limits, he must provide personal information. After one document of choice, the client will receive the “Verified” status. With this level, the user can send up to 550,000 rubles at a time. Also, after removing PayPal limits, it becomes possible to open an account in foreign currency. You can send or receive up to $5,000 in one transaction. In addition, you can receive transfers from legal entities or entrepreneurs using corporate .

All collected information is stored on secure servers, so there is no reason to worry.

What is needed to remove limits?

Restrictions are removed in just a few minutes. However, this will require some information and documents.

The client must:

- Attach bank card or bill. The action is offered immediately after the initial registration stage. If the user cancels the request, you can use the menu to add a card at any convenient time.

- Enter your passport details. The user must enter the document number and series.

- SNILS, INN, compulsory medical insurance. You must enter the number of one document to choose from.

To remove the limit in PayPal, the client will have to provide a minimum set of documents. However, if this information is not available, it will not be possible to remove the limits. Unfortunately, for new users located in Russia, all these documents are mandatory. After the new law came into force, in April 2015, forced verification of users began.

How to remove the restriction?

Removing limits is simple - there are several steps to do this. However, the user is required to be careful, since all information must be reliable. If you make even a minor mistake, the system may block your account.

Sequencing:

- Execute.

- Click “Check your account limits.” The tab is located at the bottom, on the left side.

- A window with information opens. The page contains information about account limits and describes the benefits of removing restrictions.

- Click on “Increase limits”. The button is located at the bottom of the window.

- A tab with requirements opens. On the page that appears, the user is asked to indicate and confirm bank details and enter personal information.

- All required actions are performed. If the card has been added and verified, all that remains is to enter the information. The user will have to enter his full name, country of residence, personal data, citizenship, additional document number, .

After completing all the steps, the client receives the “Verified” account status. You can find out about the successful result in the service menu.

You might be interested in a video about limits in the PayPal system:

Common mistakes

The client of the system must know what he may encounter when using the payment service. Most often, problems arise due to inattention: the user forgot his account details, did not look at the account status and made the payment, or entered incorrect details. However, it should be remembered that problems can also arise from the company’s side. If the service reports unknown error, it is recommended to immediately contact technical support. The consultant will help determine which side the failure occurred on and will help resolve the problem.

Frequent problems:

- Incorrect currency specified. Error “10001” informs the user about the need to change the monetary unit. For users from Russia, this should be rubles. You can change the currency in the settings.

- Problems sending payment. Users encounter a “601” error, indicating that it is impossible to send a payment. The problem is easily solved. To resolve the “601” error, it is recommended to clear cookies, browser history, cache and other temporary files. Unfortunately, cleaning doesn't always help. If error “601” remains, you can try to pay for the order through the “Send Money” section.

- phone number. Perhaps the user made a mistake when entering the mobile number. You must enter the correct number specified during registration.

- PayPal login error "12". A problem occurs when the password or email is entered incorrectly. It is recommended to check the data. If after three entries the PayPal login error “12” remains, you should begin restoring the lost information.

- Does not work . Error “10422” indicates problems with the payment method. The client just needs to change the transfer method. If you receive another error “10422”, you need to contact technical support. If the client cannot pay for a purchase via PayPal, the problem should be looked for in the bank account or card after communicating with a consultant.

- The buyer cannot pay for the item via PayPal. In addition to the “10422” error, there are many other errors that prevent you from paying for purchases. Clients often encounter problems that don’t go away. Funds are debited from the account, but not transferred to the seller. The money is frozen and returned only after two weeks, or after the return request has been processed.

When an error occurs, little depends on the user. The client can change the payment method, make minor settings, and undergo verification to remove restrictions. It is recommended to entrust the solution to other problems to the support service.

Users can receive notification of the restriction regardless of whether their card is verified or not.

The message you receive will contain the following phrase: Limited account access.

This can happen for several reasons. Among them, the most common is the absence of important documents or if your account has raised any suspicions among the security service.

Often the security service is not trying to interfere with your operations at all, but is only trying to protect you.

There are also frequent cases when the blocking of your acanthus will be removed immediately after you can prove that the operation was performed by you.

What sanctions apply if your PayPal is blocked?

- You will not be able to pay for your order via PayPal.

- Acceptance of payments is limited

- There is no option to close your PayPal account

- Access to viewing statistics is limited.

This practice is applied not only to novice users, but also to those who have quite a lot of experience working with the PayPal payment system.

What to do if your account is blocked

If you find yourself in email box If you receive a letter from PayPal stating that your access to the PayPal system is limited, then first of all it is very important to figure out whether this letter is real or just a scam.

Often this restriction can be removed quickly enough by logging into your account system and go straight to the “Resolution Center” tab. It is located in the top corner of your account.

After that, by clicking on the Limited Account Access sub-item, which means “why is my account blocked”, find out the reasons for limiting your capabilities. Account blocking, as we have already said, can happen for various reasons, and the decision must be made based on them. The most common problem is the absence of all or some required documents.

How can I remove restrictions from my account?

Act one

Make a copy of all documents requested by the system.

The list of required papers is as follows:

- Copy of Passport: Both a foreign passport and an official passport from your country will work equally well.

- Utility Bill: copies of your personal bills, which include bills for Internet, telephone, utilities. The only thing they don't ask for is a mobile phone bill.

- A bank statement for your account and card, which must indicate your last name, first name and patronymic, and they must certainly be identical to those that you indicated when registering your account.

A few of these documents are enough.

Act two

Now all prepared documents should reach the PayPal office. They can be uploaded directly to the site or scanned and sent to the system itself.

If you choose the latter, be sure to ensure that the data is uploaded through a secure connection to the resource.

If you have decided to send documents via fax, then you need to know a number of important features of this type of sending.

First of all, you need to print the cover page for your documents. You will receive it upon your own handwritten request, which can be done by going to the Limited Account Access - Faxing tab.

This completed form page is the starting page, and submission should begin directly from it.

Meaning of English terms

- Cover Page – title page

- Pages – the number of pages that should be sent. The title is also counted in this number.

- Phone – contact phone number, where you can be contacted at any time.

- Enter a new email – enter your new address Email, if the one that was specified for the first time does not work for some reason.

- Comments is a comment item in which you must indicate which documents you sent, as well as write everything that you consider necessary.

Act three

The company's security service will review the copies of documents received from you within 3-5 days. As a result of the verification, you will receive a response from an official representative payment system PayPal.

There can only be two options.

The first one is pleasant: restrictions have been lifted.

Second, less desirable: insufficient data provided. In this case, you need to carefully study the message received and provide the company with additional documents. Which ones exactly will be indicated to you in the letter.

Remember: the company decides what the transaction limit will be individually for each client, drawing its conclusions based on the information you provide. And therefore, if you receive the message “Based on the information you provide, we will determine your Sending Limit” - take it for granted.

If you just have to do this, then be very careful when providing documents and filling out forms, so that later you don’t have to redo everything and wait for a response from the administration.

________________________________________________________________________________________

Good afternoon.

1. First of all, I note that all card blockings individuals(as well as blocking current accounts of companies/individual entrepreneurs) is not some whim of the bank and not some accident that cannot be predicted, but the consequences of the violations you commit.

In short, there is already a fairly well-known law 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.” The law itself has quite a few specifics, namely, it says that transactions for one-time amounts of six hundred thousand rubles are controlled and they are indeed controlled, but this will not help you in any way understand the reasons for blocking cards, since banks control many other transactions and for many other parameters.

In general, everyone who makes a large number of card transactions is at risk - freelancers, online stores and other companies that receive payment for goods/services on the cards of individuals, those who receive non-salary payments from legal entities. individuals/individuals, cryptocurrency traders, financiers, those who play on exchanges, receive payments from bookmakers, those who use online exchangers, who receive large sums from abroad and a huge number of other persons whose activities are related to the large quantity card transactions.

Certain specifics are set out in the Appendix to the Regulation of the Bank of Russia dated March 2, 2012 N 375-P “On the requirements for the rules of internal control of a credit organization in order to combat the legalization (laundering) of proceeds from crime and the financing of terrorism” - there is a list on 18 sheets , which contains the parameters by which banks must identify suspicious transactions.

What does this look like in practice - the Central Bank has developed criteria for identifying suspicious transactions, banks, based on these criteria, have developed their own automated systems, which automatic mode track all transactions according to specified criteria and if the system recognizes your transactions for a certain period as suspicious, you receive a request under 115-FZ.

Therefore:

A) Requests under 115-FZ are generated automatically by an automated system. Many people think that this specific person sits in the bank and chooses who to get to the bottom of, to whom to send the request. This is wrong! All requests are sent automatically if you do not comply with the parameters by which it works automated system jar.

B) Statements that “banks have become insolent and are blocking whoever they want” are all nonsense. Requests are formed based on strictly defined criteria; there are no “random” requests. Moreover, I note that the specified criteria of the Central Bank are the same for all banks, therefore, in my experience, stories in the format “Sberbank constantly blocks, but bank “xxx” does not block anyone” is also nonsense. There are indeed certain differences between banks, and sometimes quite significant ones, but the common vector for all banks is still the same and there are risks when working with any bank.

On the other hand, I would like to note that many blockings are indeed unfounded and, in my experience, a significant part of bank blockings can be challenged in court, but in all cases it is better not to count on challenging the bank’s actions, but to initially work so that you do not receive requests.

C) The mere fact of receiving a request is already evidence that your transactions in the bank have been recognized as suspicious and, accordingly, this already means that since you were working before the request, you cannot continue to work, otherwise the request may come again even if the bank does not do it for the first time the claim will be withdrawn (even if all transactions are formally legal).

D) I would also additionally note that the same requirements equally apply to payment systems (Yandex.Money, Qiwi, WebMoney wallets, etc., although in practice they are generally more loyal).

2. Regarding the blocking procedure. The order is usually as follows:

A) You do not comply with the criteria of the Central Bank.

B) The system automatically generates a request that you receive, in which the bank asks you for “the economic meaning of the operations being carried out” and a number of documents that should help the bank determine whether your operations are connected with something illegal or not. At this stage, as a rule, the bank already limits the ability to use the card until a decision is made based on the justification and documents provided by you.

C) You provide the requested documents.

Here, in practice, the most common mistakes are the following:

- the person begins to wave a saber and declare that the bank’s actions are illegal, I have not violated anything (see point 1 and the arguments that requests should not just come, although banks do often request a lot of “extra” and similarly, requests often come in situations when you have not done anything even remotely illegal) and refuses to provide documents. By such actions, you actually refuse to fulfill your obligations to provide documents under 115-FZ, and this entails very bad consequences, including including you on the black list of the Central Bank (which already contains about 500,000 people and companies, a huge number of which are really not were engaged in no crime, but simply carried out operations incorrectly, or took the wrong position after receiving a request about the bank).

It’s also a common mistake - a person doesn’t really need the card (for example, there is no money on it anymore and there is no interest in using it anymore) and he decides that I won’t provide anything, I’ll close it and that’s it, since I don’t need it.

Another common mistake is to count on the fact that you will be able to repel any claims by providing contracts to confirm the transfers, regardless of the nature of the transfers. You need to understand that the bank can block you not only when there is direct evidence that you have violated the law, but also when the very nature of the transactions gives reason to believe that the transactions may be related to illegal activities, even despite the documents you provided. The practice of specific banks is of great importance here.

It is also a common mistake to give an answer without a preliminary analysis of the situation with a lawyer, since there are many other small and often formal aspects of interaction with the bank at the stage of receiving a request, failure to comply with which can result in a blocking even in a situation where it could have been avoided and when Indeed, you carried out exclusively legal transactions.

D) A specific bank employee reviews the documents and ultimately makes a decision on your situation (accordingly, at this stage there is already a certain dependence on a specific bank employee) and either removes all claims and all restrictions on the card, or leaves the blocking in force and, as a rule, this In this case, you are asked to write a statement about closing the card “at your own request.” Also in practice, after receiving documents, sometimes the bank may request additional documents.

3. You may ask - how is it possible, my friend/acquaintance spends huge sums through cards and no one blocks anything for him despite all the restrictions, why then was I blocked?

The answer is quite simple, several options are possible:

A) Your friend/acquaintance intentionally/unknowingly performs transactions in such a way that the bank/payment system does not recognize them as suspicious, since if the criteria are met, you will not receive a request.

B) It’s just that the total duration of operations has not yet led to operations being recognized as suspicious and blocked, and sooner or later this will happen.

4. Consequences. Based on my practice, I can say that:

A) In case of blocking, the clear consequence is a damaged relationship with the bank that blocked you, that is, cards/accounts will no longer be opened for you here. Although there are still exceptions here.

B) A worse consequence is being blacklisted by the Central Bank. If you actually engage in crime or if your transactions are not connected with anything illegal, but at the same time you take the wrong position in dealing with the bank, there are serious risks of getting blacklisted by the Central Bank and in this case, not only the one who blocked you will not want to cooperate with you bank, but also any other bank in general, since all banks will see that you are on the Central Bank’s blacklist.

Q) Many people are still interested in whether the bank will give the money back? Here I will just say that according to the law, yes, the bank is obliged to give the money, but in my experience, it is not so easy to get your money from the bank, there are certain nuances.

So, to summarize:

1) There are no random blocks; each block is a series of mistakes on your part.

2) It is very important to take the right position in communicating with the bank, prepare correct explanations regarding the economic meaning of the operations being carried out; the slightest mistakes at this stage can lead not only to account blocking and difficulties in returning money from the bank, but also to your blacklisting by the Central Bank with all that it implies.

3) It is very important to initially work so that you take into account the requirements of the Central Bank and the banks themselves when carrying out operations, and do not carry out operations that are questionable according to the criteria of the Central Bank, since only this can protect you from blocking.

I hope my answer helped you.

Sincerely,

Vasiliev Dmitry.

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned How to put a password on a folder on a Windows computer without and with programs

How to put a password on a folder on a Windows computer without and with programs Pluton – Free Bootstrap HTML5 One Page Template

Pluton – Free Bootstrap HTML5 One Page Template History of ZX Spectrum: Myths and reality New Spectrum

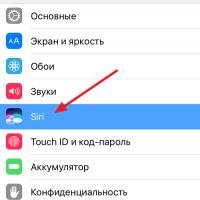

History of ZX Spectrum: Myths and reality New Spectrum Voice assistant Siri from Apple Siri functions on iPhone 6s

Voice assistant Siri from Apple Siri functions on iPhone 6s How to roll back to a previous version of iOS?

How to roll back to a previous version of iOS? Unlock iPad in four days

Unlock iPad in four days