Payment system Z-payment. Payment system in Russian or should you trust your money to Z-payment

Good day, readers of my blog. Today, many Internet users, novice webmasters, bloggers and freelancers are wondering how to top up a z payment wallet?

Haven’t you ever had a situation when you urgently needed to buy some product or service online? Or did you not lose money by using “left” payment systems, when adding money, it went “nowhere?” Thanks to the Z Payment wallet, you can be sure that all transactions with your financial funds will be carried out as securely as possible.

However, despite the fact that there are quite a lot of methods for adding money to the Z Payment system, not all users know how to do this. If you don’t want to sit online for a long time, clarifying how best to work with the Z payment wallet, then it’s time to learn! The first thing that a client of this system needs to understand is that most operations in it can only be performed by payers who are certified (registered) in the system. You can register by following the link.

Registration in the system will not take you much time. To register, go to https://z-payment.com.

- e-mail – address Email. I recommend having a separate one Mailbox at gmail.com;

- number mobile phone;

- password – come up with a complex password or use a password generation service, for example;

- confirm the previously entered password;

- enter the captcha - the numbers from the picture;

- then you need to read the z-payment public offer and check the appropriate box.

After filling in all the fields, press the button "Registration".

Also, if something is not clear to you, at the bottom of the registration window there are links to a video lesson that will help you register correctly with the service.

If all the data is entered correctly, the system accepts it and sends an email to the email address you specified during registration. By clicking on the link from the email to confirm your registration, you gain access to your account in the system.

Registration is now complete. Nothing complicated. On all sites, the registration procedures are very similar and have approximately the same steps. Therefore, if you have registered on some blogs, services, websites, then it will not be difficult for you to register a z-payment wallet.

How to top up your account?

Having logged into your own created account by entering the login and password specified during registration, you need to open the block on the right "operations", and then click on the section "Replenishment".

Next, you should indicate exactly how much you want to deposit into the system and click on the button "Fill up a purse". Then, carefully study all the conditions and, if you agree with them, check the appropriate menu item. Also, the user needs to note which payment method he plans to make.

If necessary, you can add finance using transfers from a bank, or using an ATM or even from. I usually use Qiwi, where the percentage is lower and the translation speed is good. Alternatively, you can top up your account using regular transfers or terminals. At the end, you can see an account statement on the monitor screen, where all the transfer details will be.

By adding a payment to your account in this way, you will have the money within half an hour. To confirm the application, you just need to press a button and write down the account number and the total amount issued. After all the manipulations have been completed, you will receive a notification letter with all the transfer data. If you do not use the application, it will be canceled after three days. You can make other cash statements using the same method.

If you want to learn more about working with the z payment system, subscribe to blog updates and recommend it to your friends and acquaintances. That's all for today, bye-bye everyone.

Best regards, Roman Chueshov

ePayments- a payment system with which you can receive and withdraw earned money, make money transfers and other transactions. It is possible to withdraw money from a Webmoney (WMZ) wallet to an Epayments Prepaid Mastercard, and then cash it out at any ATM. You can top up and withdraw money from your wallet different ways, among which there is a bank transfer, Mastercard or Visa plastic cards, cryptocurrencies, Yandex, Qiwi, WebMoney.

ePayments official website -

The ePayments wallet can be linked to a crypto exchange to trade cryptocurrency there and exchange it for fiat. The most important thing is the ability to order an international Mastercard debit card in dollars or euros, transfer money from your account to it and withdraw cash from an ATM or pay for purchases. The card is chipped with PayPass contactless payment technology and is issued under license from Mastercard International Incorporated.

Payment system is not a tax agent and does not provide data on user accounts to the tax authorities, does not disclose information about clients to third parties without a decision from a UK court.

Important information! Since April 2017, the cost of ordering an ePayments card has been reduced. Now the cost of ordering a card is only 5.95 USD for a dollar card and 4.95 EUR for a card in euros. We remind you that previously the order cost was $35. Delivery, as before, is free to any country.

To order an ePayments card, you need to go through account verification and top up your account in a convenient way: by card, bank transfer, from a Yandex.Money wallet or cryptocurrency. Update: since 2018, the release of new cards has been temporarily suspended; all previously ordered ones are working. From January 15, 2019, delivery resumed for EU citizens.

If you need other methods of replenishment or withdrawal, you can use reliable online exchangers (Prostocash, 60cek or Baksman), selecting the required exchange direction and specifying the required information. For example, exchanging Bitcoin rubles for ePayments:

The company is developing, so new opportunities for clients are constantly being added. On April 15, 2015, the Payments company redesigned the site. The changes also affected mobile applications: An update was released for iOS on August 5, and for Android on September 2. In July 2016, it became possible to withdraw funds to cards of any bank, and from November 2016, transfer money to a Yandex.Money wallet. In December 2016, the ePayment payment system received the status of a principal member of MasterCard, which confirms its reliability and security for customers.

From March 23, 2016, it became possible to open an Payments account and top it up with Russian rubles in any bank. Since October 6, 2015, the company began working with Bitcoin and Litecoin cryptocurrencies. Since February 2016, the long-awaited opportunity to top up your account with a VISA, MasterCard, Maestro bank card has appeared. Conditions: the card must have the 3-d Secure payment protection service activated (added at the card issuing bank or online banking).

Payment system ePayments founded in 2011. The main office is in London. The activity is monitored by the Financial Conduct Authority regulator (registration number 900172), and there is also permission to issue electronic money. The FCA is one of the toughest financial regulators. The company's services are used by people from more than 100 countries.

Information about regulation can be found on the FCA website, here is a small screenshot:

The system allows you to register an electronic Payments wallet in three currencies: USD and EUR, RUB, and also order the issuance of an ePayments Prepaid MasterCard® card, which  it for residents of Russia, Belarus, Ukraine, Kazakhstan and other countries. In the first two countries, cash withdrawal from the card is possible both in the card currency (USD or EUR) and in the national currency, by converting it at the internal MasterCard rate. You can withdraw cash in dollars and euros at ATMs that dispense currency, and banks set a limit on the maximum withdrawal per transaction (usually $200-500). In Ukraine, due to restrictions established by law, withdrawing cash from a card at ATMs is only possible in the national currency - hryvnia; when cashing out, funds are converted at the rate set by MasterCard. You can also get currency through a bank cash desk.

it for residents of Russia, Belarus, Ukraine, Kazakhstan and other countries. In the first two countries, cash withdrawal from the card is possible both in the card currency (USD or EUR) and in the national currency, by converting it at the internal MasterCard rate. You can withdraw cash in dollars and euros at ATMs that dispense currency, and banks set a limit on the maximum withdrawal per transaction (usually $200-500). In Ukraine, due to restrictions established by law, withdrawing cash from a card at ATMs is only possible in the national currency - hryvnia; when cashing out, funds are converted at the rate set by MasterCard. You can also get currency through a bank cash desk.

Without a commission, non-cash payments with Payments cards are possible when paying for services, making purchases where there are point-of-sale terminals (POS), for example, in shops, restaurants, hotels, gas stations, and the card currency is also converted into the national one.

Don't know how withdraw money from WebMoney safe and profitable? You can withdraw them from your WebMoney wallet to your ePayments card, the commission will be only 1% (but not less than $5), and then withdraw (cash out) them through any ATM.

Go to the Payment website -

How to register an ePayments wallet on the official website

To register a wallet in ePayments, you need to go to the official website:

The payment service provides two types of accounts: individual and business.

If you do not plan to use it for commercial purposes, but only as individual for personal needs, then you need an individual account.

The registration procedure is simple and does not take much time. You only need an email address or phone number, as well as a password. Next, a confirmation code will be sent to you by email or phone number specified during registration, after entering which you will be registered on the site.

Order an ePayments card in 2018

ePayments Card ideal for anyone who makes money online. With its help, you can withdraw, withdraw cash from ATMs, and pay for services and goods offline. It is replenished by transferring funds from your ePayments account or directly from your WebMoney wallet (you just need to link your card). The card is international, works in Belarus, Ukraine, Russia, etc.

Free delivery. You can order a card on the website in your personal account in the “Cards and Accounts” menu. We indicate:

- card currency;

- access code;

- delivery type;

- city, zip code and card delivery address.

Order ePayment MasterCard in USD:

Order a card in EUR:

The ePayments Prepaid MasterCard® card is a proprietary product of the Electronic Payments Association; it is chipped and has a magnetic stripe. Please note that as of February 27, 2017, the issuer of Payments Prepaid Mastercard is Epayments Systems Limited.

The card can be used to withdraw cash from ATMs, pay for goods in stores and make online purchases in any country: Russia, Belarus, Ukraine and others. The Payments card can be linked to your PayPal account to pay for goods and services online.

Issued in two currencies: USD and EUR. The cost of ordering a card is 5.95 USD per dollar card, 4.95 EUR per euro card. When ordering, please indicate the address in transliteration, for example: gorod Minsk, ul. Oktjabr"skaja, house 45, kvartira 3.

You can top up your ePayments account to order a card by bank transfer (by finding the details in your personal account), Mastercard/Visa bank card or other methods. Replenishment by bank transfer is possible in any currency, in any bank. For example, when you top up in Belarusian rubles, Russian rubles, hryvnias, they are converted (exchanged) into the currency of your e-Wallet (USD or EUR). You can also top up via Bitcoin and Litecon cryptocurrencies.

When replenishing your ePayments account with a Mastercard or Visa bank card, you must indicate:

- 12-digit card number.

- Validity.

- Security code CVC/CVV (on the back of the card).

- Last name and first name, as on the card.

- Amount (we remind you that ordering a card costs $35).

One more condition: the card must have the 3d-Secure payment protection service activated (this can be done at the bank, at an information kiosk, we connected it through mobile banking).

One of the advantages of the card is that the commission for one transaction (operation) at ATMs is only 2.6 US dollars, which is relatively little. Therefore, we recommend ordering it:

Order processing - up to 4 days. Delivery can be free by regular mail(takes 3 to 6 weeks) or DHL. In the latter case, it takes 5-10 days, but the cost is correspondingly higher - 89.95 USD or 79.95 EUR.

It arrived in Belarus by regular mail without problems and free of charge in 4 weeks.

The ePayments card can be used at all ATMs that accept MasterCard payment system cards. For example, at an ATM of one of the banks (Belagroprombank) of the Republic of Belarus:

Dollar card limits:

Obtaining an ePayments electronic wallet number

After registering in the system to receive a number electronic wallet Payments fill out an individual user profile, where we indicate:

- Last name.

- Citizenship.

- Phone number.

- Email.

It is advisable to indicate real data in order to speed up the future verification process.

After entering the data, the eWallet ePayments electronic wallet in the xxx-xxxxxx format will become available to you. You can view it in the upper left panel of your user account.

Tariffs for wallet transactions can be viewed below.

Login to your personal account.

In your Payments personal account, you can perform all available operations: find out your account balance, top up your wallet (e-Wallet), transfer money, order a card, find out tariffs, contact support, participate in the bonus program, find out your transaction history, etc.

Main features of the personal account menu

Receiving a payment password

The next step is to obtain a six-digit payment password, which is necessary for security when conducting transactions in favor of third parties. If you have forgotten it, please contact support immediately, as it cannot be replaced on your own.

Activating the card and receiving a PIN code

After receiving the card, go to the “Cards and Accounts” menu and click “Activate”.

You can get a PIN code for your card in two ways: using the "Cards and Accounts" menu, indicating your date of birth (mm.dd.yyyy), access code, and postcode, given by you to send the card or over the phone.

Transfer and withdrawal of funds from the ePayments wallet

The following withdrawal and transfer methods are provided:

- to a WebMoney wallet (deposit speed up to 15 minutes);

- to a bank account (1-5 business days);

- to ePayments card (instantly);

- internal transfer (instant);

- to a VISA/MasterCard bank card;

- to the Yandex.Money account;

- to the bitcoin, litecoin account.

The ability to transfer funds from your wallet balance to VISA/MasterCard® cards exists only for cards issued by banks of the Russian Federation.

For residents of Russia, Belarus, and Ukraine, the best option for withdrawing funds is through an Payments card, as well as to a WebMoney wallet or bank account.

Limits and the ability to access a particular operation depend on the status and type of account.

For now, funds can be sent from the system only in the specified currencies - USD and EUR.

Replenishment limits: for unverified users - $2500 per year; for verified - unlimited.

Commission for transfer and withdrawal from Payments wallet:

Topping up your wallet and ePayments card

You can top up your ePayments wallet in the following ways:

- by bank details, which can be seen in your personal account;

- VISA or MasterCard® card;

- from a Yandex.Money wallet;

- through exchangers: Prostocash, 60cek, Baksman.

Card replenishment:

- from the Payments wallet;

- from a WebMoney wallet.

For residents of Russia, Belarus, Ukraine on this moment replenishment is available by bank card and using bank details, which everyone can see in their personal account. You need to save them (print them out) and go to the nearest bank. You can top up with any currency (ruble, hryvnia, dollars, etc.), the funds will simply be converted into the currency of your wallet at the bank exchange rate on the day of receipt.

To top up your Payments Prepaid MasterCard, you can use your WebMoney wallet and then transfer from the card to your account.

Replenishment from WebMoney is possible only in US dollars (WMZ) and euros (WME).

Replenishment limits: for unverified users - $2500 per year; for verified - unlimited.

Commission for replenishing your ePayments wallet:

Topping up an ePayments card from a WebMoney account and linking it to it

It is possible to top up an ePayments card from a WebMoney wallet and vice versa - withdrawal from an ePayments card to an account in WebMoney, as well as withdrawal to it. The exchange service commission is 1% (min $5/€5) for deposits and 2% for withdrawals.

Requirements of the WebMoney system to complete the operation:

- Obtaining a WM Certificate is at least formal; for this you need to upload a scanned copy of your passport.

- WMID registration at least 7 days ago.

- Complete match of personal data in WebMoney with data on the Payments card. If your information does not match, write to support: they will change the spelling to the correct one.

- It is mandatory to go through the verification procedure (linking) of the Payments card to the WebMoney wallet. To do this, you need to upload a photo of the front side of the card on the Webmoney website. detailed instructions available.

To verify (link) the card to WebMoney account you need to do this:

- We go to the WebMoney website, go to the “Bank Cards” section.

- Linking a new card.

- Enter its number and the name of the issuing bank.

- Then we add a scan or photo of our passport and the card itself.

The whole procedure does not take much time; the notification is sent to the keeper and mailbox. Once linked, there will be a green check mark next to it. After this, the card is ready to accept funds.

Verification

There are two levels of verification in the Payments system: verified and unverified. Transaction limits depend on the level of verification. To undergo verification, go to the “Settings” menu in the “Verification” subsection:

- Implementation of financial control by the British regulator FCA.

- Possibility of ordering a Prepaid MasterCard and paying for services using it in any country in the world.

- Possibility to open a wallet in euros, dollars, rubles for free.

- Transfer between wallets and to the Payments card without commission.

- Withdrawal from Payments account to VISA or MasterCard bank cards.

- Possibility of registration and use of services for residents of Russia, Ukraine, Belarus.

- Low commissions when withdrawing money from a card.

- Free e-Wallet.

- Replenishment from plastic cards.

- Three account currencies - euros, dollars and Russian rubles.

Flaws:

- There are low transaction limits for unverified users, so we advise you to go through the identification process.

- In April 2018, the release of new cards was suspended.

September 1, 2007. It was developed based on the Transactor technology platform. Read more about the exciting history of the emergence of Z-payment, which dates back to 2002, in a separate article. The headquarters of Zet Payment LLC is located in Irkutsk, the general director is Alexander Strelov.

Now Z-payment is a powerful financial tool for automatically accepting payments on websites and for instant payment for goods and services on the Internet. More than 8,500 stores are currently connected to the system, and it has more than 60 payment methods. Z-payment works with almost any type of transfer - bank, postal, money, through terminals, including electronic ones, as well as electronic currencies, plastic cards, mobile and cash payments. The system provides a rich toolkit for stores, partners, developers and users. To connect stores there is a large set of ready-made modules (for Shop-Script.ru, osCommerce.com, 1C-Bitrix, NetCat. Joomla!, CMS ShopCMS, CMS Drupal, Joomla, XСart, OpenCart, DataLife Engine, etc.)

The unit of payment in Z-payment is ZP, which is equivalent at par to 1 Russian ruble. The wallet number in Z-payment looks like ZP12345678 and is assigned immediately after registration in the system is completed.

REGISTRATION IN Z-PAYMENT AND WORKING WITH THE SYSTEM

Before registering with Z-payment, it is recommended to carefully read the Public Offer. The registration process itself is very simple and takes no more than a minute. In the registration form, you must indicate your last name, first name, patronymic, mobile phone and e-mail, and also create a password. After filling out the form and clicking the "Registration" button, messages with a special code are sent to your e-mail and mobile phone to activate your account (it is more convenient to use the first one, since the letter contains a ready-made link with the code, after clicking on which the account is immediately activated, and when used code in SMS, you must enter it on the site manually).

General registration data (full name, email address) cannot be changed, so be careful when filling out all fields.

By registering in the system, you have the opportunity, without leaving home, to pay from your account for purchases in an extensive catalog of online stores connected to the system, public utilities, mobile communications and Internet, television and other services. The system account has the ability to send SMS to any phone mobile operator for only 1 ruble.

Among the additional financial services of the system, it is worth noting the sale of prepaid virtual MasterCard cards with denominations from 100 to 15,000 rubles.

Certified users of the system have the opportunity to order a connection to their VTB-24 plastic card account for prompt withdrawal of funds from their wallet.

Provider services can also be paid through the system’s electronic terminal (to confirm transactions and gain access to Personal Area you need to specify an e-mail).

Certification in Z-payment

ZP certificate is a certificate in digital form, which is issued to the system participant who provided the system with his personal data. Physically, the certificate is one of the attributes of the wallet and means its higher status in the system than the wallets of non-certified participants. There are as many as 10 types of certificates in the Z-payment system! This:

- Anonymous certificate

- Personal certificate

- Store certificate

- Temporary certificate

- Manager Certificate

- Company certificate

- VIP client certificate

- Developer Certificate

- Dealer Z-Payment

- Z-Payment Agent

Immediately after registration, the user is automatically assigned an Anonymous Certificate. Users with this type of Passport have a minimum set of rights and restrictions on the number of ways to withdraw funds from the system (withdrawal to plastic cards, ordering a plastic card is not available), and also do not have the ability to create stores.

In order to start receiving payments on the site, you must have at least a Personal Certificate, and legal entities- Store certificate. Z-payment provides 4 options for obtaining a Personal Certificate: a) payment from a plastic card, b) CONTACT money transfer, c) upon an application with a signature certified by a notary and sent to the company address by mail, d) automatic certification through a personal certificate Webmoney(or higher), if you have it, of course.

Read more about certificates in the Z-payment system in this article.

Knowing the user's wallet number, you can view the available information about him and his Certificate directly on the payment system website.

The form for entering your wallet number for verification purposes is located at the bottom of the left column of the site.

Deposit and withdrawal of funds. Tariffs of the Z-Payment system

Internal transfers and payments in the system are carried out instantly without commission.

As for the methods for replenishing your wallet, there are currently more than 40 of them in the system and their number is constantly growing. This includes payments from Internet wallets of all popular Runet payment systems, Internet banking, payment transfer systems such as CONTACT, Unistream, Anelik, MoneyGram, Western Union, etc., replenishment through terminals (Eleksnet, Multikass, X-Plat, etc. .d.).

The number of methods for accepting payments on sites has already exceeded 50, and, in addition to the listed methods of replenishing your wallet, includes bank transfers, SMS payments in the CIS countries and Europe.

Withdrawal of funds from Z-payment is possible to wallets of other payment systems - Webmoney (R-wallets only), RBK Money, Yandex.Money, QIWI, etc. Holders of certificates higher than anonymous can withdraw money to a plastic card or bank account, as well as by postal transfer . In addition, there is a large number of exchange services, through which you can withdraw money in other ways (Z-payment commission for exchangers - 0%). Almost all methods of withdrawing funds from the system have a commission of 3%.

It hardly makes sense to present a table of system tariffs here due to its enormous size; a number of methods for replenishing an account and receiving payments to a wallet includes agent rates; You can see the tariffs you are interested in on the website itself. Also, be aware that this table is different for users with different types certificates. We note here only transactions with zero commission. This:

- Topping up your account by bank transfer in rubles;

- replenishing your account through Sberbank of the Russian Federation;

- replenishing your wallet using online banking;

- replenishment of the wallet through N-CHANGE.net;

- accepting payments on the website via Webmoney (R- and Z-wallets).

ZP wallet security

Z-Payment provides quite a few ways to protect your wallet compared to most payment systems. The most important factor Wallet protection is, first of all, the presence of a Certificate. Other security measures include:

1. Payment password, which is issued upon registration. Without entering this password, not a single significant action can be performed in the system. You can change the payment password, but to do this you need to know the old payment password and the system login password.

2. Specifying a list of IPs or IP subnets from which login under your login is allowed. Limiting one IP address only makes sense if your IP is static; You can also specify the subnet mask of your Internet service provider.

3. Control e-mail or mobile phone number to which notifications and confirmation codes for transactions on the site will be sent. You can order confirmations to be sent both by e-mail and via SMS. You can specify the types of operations that require confirmation on the “Security” tab; these include sending a one-time password when logging into an account, making a payment, as well as notifications about logging into an account and conducting transactions in the account.

4. You can also completely prohibit accepting payments and/or payments from the Z-payment wallet.

5. The system has a free “Personal Safe” service. A safe is a separate storage facility that has additional levels of protection against unauthorized access. You can independently configure the security level of the storage and move funds from the wallet to storage in the safe. You can only store money in the safe; it is not available for payment or withdrawal. The safe balance is displayed next to the wallet balance and is part of the overall account balance. Additional levels of protection are almost identical to those listed earlier for the entire account: access password, control e-mail and parameters for distributing funds when receiving a transfer to the wallet. For more reliable protection It is recommended to indicate the number cell phone and identifier in the WebMoney system. In addition, it is possible to specify a list of allowed IP addresses or a subnet of addresses for access to the safe; access to the safe from other addresses will be prohibited. Of course, maintaining a safe does not make any sense if the passwords and paths to access it are completely identical to those for logging into the system.

When opening a safe, you must specify an access password; if the password is correct, the system sends one-time access codes to the control e-mail, phone and WMID, if they were specified in the settings. Access codes are always different. To successfully open the safe, you must enter all received codes correctly.

Conclusion

Analysis of popular social services shows that representatives of the system, apparently, are always open to dialogue, they are present at all major platforms related to the topic of electronic payments and their development, and immediately respond with explanations to negative reviews about the operation of the system that sometimes appear on the Internet. The service has sites in

October 24, 2010 at 01:44Payment system in Russian or should you trust your money to Z-payment

- Payment systems

Many of you know the Z-payment system for accepting payments. They also position themselves as a payment system with ZP currency.

On October 19, without any warnings, the system went to “update and configure software”, which lasted for 3 whole days (until October 22) after which they asked to change their passwords.

But weren't they broken?

And this is not the first time.

Just recently, on May 11 to be precise, the system also suddenly stopped working. When I entered the site it hung standard pages Apache "403 Forbidden". That's all. No more information, they didn’t even bother to put a plug on the site. After 3 days, the system came to its senses, and it was necessary to urgently change account passwords and payment passwords. Without this they would not allow anything to be done.

And this time everything repeats itself - they ask to change passwords, after logging into your account there is a redirect to a page with a password change, but bad luck - the browser reports that "the server redirects the request to this address in such a way that it will never complete". Those. in fact, nothing can be done inside the account. (upd: fixed by Sunday evening)

And with this error, they calmly rest the weekend, and judging by the fact that this has already been for more than a day, no one monitors the system at all on the weekend. In fact, it turns out that the service has not been working since the 19th.

The question arises: is it worth trusting your money to a system that has not been working fully for 5 days? And in which, after a “software update,” you urgently need to change passwords. And this is not the first time in the last six months! Think about it.

The second question is the attitude of the system towards its users. Actually, I assume that when carrying out some work, you need to notify your users about it. Moreover, this is not just a payment system (as they position themselves), but also a service for accepting payments, which is used on various sites. Stores accept money through them. And Z-payment allows itself to turn off the system for 3 days without warning (in fact, more - the service is still not working).

But there is undoubtedly progress - in May they had “403 Forbidden” on their website for three days and no one knew what happened and whether it would continue to work. Now they were putting up a plug with information. But the fact remains a fact. Even if this is an emergency situation, no one bothers to notify about it through the mailing list, so that users and stores at least just know about it and do not plan any business related to Z-payment. And now most stores learned about this from their users.

Some users on the forums write that Z-payment was broken both in May and now (the argument is - otherwise, why do you need to urgently change passwords). They advise you to withdraw money (but you cannot withdraw it at this time - because the service does not work after logging into your account). I don’t presume to say whether this is true or not. Z-payment employees say no (and who would say that “yes, we were cheated”).

I personally worked with Z-payment as a store. I don't plan on it for a second. In this regard, the question is whether anyone from the respected habra community can suggest a similar service. Interested in accepting off-line payments (bank, post office, etc.). For electronic currency there is Robokassa (although also not a gift).

UPD. On Sunday, late in the evening, the service finally started working in full mode, i.e. There is no longer an endless redirect to change your password. Now you can finally change your password and withdraw all your money. Total downtime from October 19 to October 24. No warnings before, no apologies after. This is how the Z-payment service works. Think at your leisure (those who use) what can await you tomorrow.

UPD2: If Z-payment employees are reading this post, then tell your superiors that you need to think about your users first. And warn them about a long shutdown in advance by letter. And after turning on the system, you need to finish everything and only after that go to rest. You are still a payment system, and not some left-hand portal. Maybe this post on Habré will stimulate you, otherwise you are ignoring ordinary requests.

There are dozens of different payment systems. All of them work with different currencies, allowing ordinary users to profitably exchange, transfer and receive funds. With the help of such resources, each of us can pay bills, buy goods and services, and perform a huge range of other actions.

It turns out that you can also make money using payment currencies. At least that’s what the organizers of one of them say (it’s called Payments24). Reviews note that information about earnings using this system is constantly present on the official website, and, thus, it recruits new participants.

What kind of income is this, how you can take part in it and what you can get out of it all, read in our article.

Offer

It all starts with the Internet user learning about a very attractive vacancy, which is posted on various forums, message boards and advertising sites. Its essence lies in the need to send funds to a list of specified accounts. Of course, all operations are carried out within the Payments24 service.

Reviews also report that they paid good money for such seemingly “dust-free” work - this is how they lured new participants. And, if you believe the information posted on various sites, there were really a lot of people who believed and wanted to try.

Possibilities

The work offered by the organizers of the http://Payments24.in system was noted by reviews as associated with great opportunities. In particular, it was said that earning money by sending money allows you to have a free schedule. The participant could work from home, at any time of the day, in such a way that he only had time to make the next newsletter. Agree, this is very convenient in terms of time, because there is no need to go to the office, sit there, return home, and so on. All this would be a reality if you get the kind of job that was written about on the website inform.Payments24.in by “reviews” of successful workers (and in fact, by the creators of the resource themselves). As it turned out, this is a hoax, and in reality such work is not provided here. However, more on that later.

Tasks

One very important point that was emphasized and used by the Payments24 payment system is the reviews called the tasks themselves. Yes, they looked like this: the person who is hired is sent a list of bills to pay. He needed to manually enter the details of these accounts and make payments. The most reliable appearance was created that the person was actually sending money, that it was being debited from the account in the system, that he was completing his task. This greatly made the participant think that everything was for real, and this is confirmed by numerous reviews. Payments24 looked like a real payment system website, although it was not one.

Time to complete the task

In addition to the fact that all the work was based on the real actions of participants in the system, we can also say that it took certain time. For example, a person who registered to complete tasks was given a certain period of time by the Payments24 system (reviews can confirm this). It, as mentioned above, was not tough enough and gave the participant the opportunity to do everything without much effort; but, on the other hand, the timing played the appearance of another factor that adds credibility.

Further requirement

We recreate a picture by which you can understand what the described service is like by studying user reviews. Payments24, according to them, provided tasks only at the beginning. Subsequently, the employee accumulated a certain amount of money ($400, which supposedly could be withdrawn from the account), after which he was offered to withdraw his money. Naturally, a person agrees to take full advantage of the fruits of his labor, and is glad that he managed to do this. But, as reviews show, Payments24 was preparing another trap - verification account.

Everyone has heard about this: according to security rules, if you want to take part in the exchange of funds, transferring them to other participants, receiving payments and other operations, you need to confirm your account. As a rule, this can be done by providing your documents (sending a scan of your passport, for example). Our “payment system” has developed its own procedure.

Buying a card

One of the options that brought the participant closer to the coveted amount of $400 was the purchase bank card, supposedly released by this system. Its cost was about 200 dollars, which, what is most interesting, the participant could contribute only from his own personal funds. It is understood that it was impossible to “count” this amount from the money he earned by sending funds to other accounts. And this is the first signal that should have alerted any user. It turns out to be a rather strange situation: the money seems to be there (it was earned!), but there is no opportunity to use it (for an unknown reason). In addition, it was necessary to deposit your own funds, which is a completely illogical move.

Account activation

There was an alternative to buying a card. Reviews of the Payments24 “work” (if that's the right word here) indicate that the person may have also purchased a special activation for their account. Its price was half that and was about $95. And, as you can guess, this place also required you to deposit your personal money. It was again impossible to count this payment into the $400 that the participant earned. The requirement to pay in order to also work in this service is too suspicious. It was supposed to alert everyone and protect them from financial losses.

Payout of real funds

Actually, now we have reached the point for which everything was organized with accounts and earnings from sending money. This, again, is confirmed by multiple reviews. Payments24 simply collected money from those who wanted to cooperate with them, due to which it continued to function in the future, generously buying advertising in various projects, creating new sites to attract people.

Scale

By the way, the reviews contain information that such a project is not an isolated one. It says that there is a whole network represented by sites designed as payment systems. Therefore, if we look for positive reviews about Payments24, we will find the same comments about other resources (for the reason that they were created automatically using the same template). And all these resources are united by one offer: the opportunity to earn money by sending money to accounts with the further right to “confirm the account” and pay your 95 or 200 dollars.

Therefore, we can only guess how many sites actually operate in this niche under the guise of payment systems, and most importantly, how many people actually paid the organizers to start earning big. It’s just not worth explaining that in the future there was no response from the representatives of the service, and the person was actually ignored in the future, since he was of no interest to the managers of the “payment system”. Again, we are told about all this by reviews left on various sites. Payments24 is named in the same spirit, but the essence and general meaning of the proposal remains the same.

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned

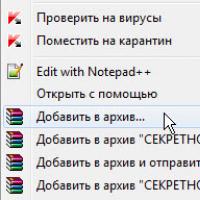

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned How to put a password on a folder on a Windows computer without and with programs

How to put a password on a folder on a Windows computer without and with programs Pluton – Free Bootstrap HTML5 One Page Template

Pluton – Free Bootstrap HTML5 One Page Template History of ZX Spectrum: Myths and reality New Spectrum

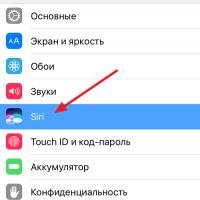

History of ZX Spectrum: Myths and reality New Spectrum Voice assistant Siri from Apple Siri functions on iPhone 6s

Voice assistant Siri from Apple Siri functions on iPhone 6s How to roll back to a previous version of iOS?

How to roll back to a previous version of iOS? Unlock iPad in four days

Unlock iPad in four days