Common mistakes when connecting to the electronic budget gis. Treasury on signing budget (accounting) statements with an electronic signature Transformer not found electronic budget

Regularly describing on this blog new legislative and regulatory acts regulating the use of electronic documents in government administration and business activities, I am well aware that in practice their provisions will not always be implemented. Finding out how all these rules actually work is quite difficult, since government agencies are not inclined to publicly report mistakes and shortcomings in their work.

Letter of the Treasury of Russia dated June 1, 2018 No. 07-04-05/08-11045 “On signing electronic signature budget (accounting) reporting” slightly lifts the veil of this “secret”.

The Federal Treasury conducted an analysis of the practice of signing financial statements with an electronic signature by the main managers, administrators, and recipients budget funds, chief administrators, budget revenue administrators, chief administrators, administrators of sources of financing budget deficits, state budgetary and autonomous institutions as of April 1, 2018. Signing is carried out in the “Accounting and Reporting” subsystem of the state integrated information system for public finance management “Electronic Budget” (PUiO GIIS “Electronic Budget”).

Based on the results of the inspection, it was established:

- Absence of the “Approval” role (UO.SO.003) of authorized persons of a number of reporting entities;

- Signing of budget reports by persons not provided for in clause 6 “ Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation" and point 5 " Instructions on the procedure for drawing up and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions».

Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation (approved by order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n)In this regard, the Federal Treasury has instructed:6. Budget reporting is signed by the head and chief accountant of the subject of budget reporting.

Budget reporting forms containing planned (forecast) and (or) analytical (managerial) indicators, in addition, are signed by the head of the financial and economic service and (or) the person responsible for the generation of analytical (managerial) information. These forms are signed by the chief accountant in terms of financial indicators generated on the basis of budget accounting data, or when generating consolidated budget reporting in terms of data generated by summarizing the indicators of budget reporting used in consolidation.

... Budget reporting compiled by centralized accounting is signed by the head of the subject of budget reporting, who has delegated the authority to maintain accounting and (or) generate budget reporting, by the head and chief accountant (specialist accountant) of the centralized accounting department, which maintains budget accounting and (or) generates budget reporting .

Instructions on the procedure for compiling and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions (approved by order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n)

5. Accounting statements must include performance indicators of all divisions of an economic entity, including its branches and representative offices, regardless of their location.

Accounting statements are signed by the head and chief accountant of the institution. Accounting reporting forms containing planned (forecast) and analytical (managerial) indicators are also signed by the head of the financial and economic service (if present in the structure of the institution) and (or) the person responsible for the generation of analytical (managerial) information. The chief accountant signs these forms in terms of financial indicators generated on the basis of accounting data.

... Accounting statements prepared by the centralized accounting department are signed by the head of the institution that transferred the accounting, the head and chief accountant (specialist accountant) of the centralized accounting department, which carries out accounting and (or) preparation of financial statements.

- Inform reporting entities about this by June 8, 2018;

- Ensure the submission to the territorial bodies of the Federal Treasury of applications for connection (change of information and (or) authorities) to the PU&O GIIS “Electronic Budget” with the addition of the role “Approval” (UO.SO.003) by persons authorized to sign budget reporting, provided for by the above instructions .

My comment: It turns out that some organizations, when providing reports, do not track at all whether the persons who signed the reports have the appropriate rights. The Treasury found a solution quite quickly - it simply will not make it possible to sign the reports, and therefore submit them electronically, if the noted deficiencies are not corrected.

When submitting reports in the Electronic Budget system, errors often occur. Experts from the journal Accounting in an Institution have prepared a large memo with errors in the Electronic Budget and their step-by-step solutions.

The memo is divided into several sections:

- Creation and editing of reporting forms;

- Import;

- Signing;

- Input and editing.

Creating and editing reporting forms

Most often, problems in GIIS Electronic Budget arise with the creation and editing of reporting forms. In you will learn what to do if the following errors occur:

- Upon entering Personal Area The list form of documents is not displayed;

- When logging into your personal account, button icons are not displayed;

- After the 1st day of the month, reports in list form disappeared;

- The system displays an error: when creating or importing reports according to Instruction No. 33n, the chapter code was not filled in;

- Cannot save report after making changes;

- The text part of the explanatory note cannot be loaded;

- It is not possible to refill reporting forms based on other reports;

- You must enter a filter to find the desired value;

- A form with zero indicators has been drawn up, the document has been assigned the status

“There are no indicators.” The report does not change its status to “Submitted”; - The system displays the error: “The personal account was not found in the f. report. 0503779";

- The form is in the “Control failed” status. The report cannot be edited. What to do with him?

- How to return a report with the status “Canceled”?

- Report monitoring found an error that is acceptable;

- In form 0503769, the required account is not selected from the “Working Chart of Accounts” directory;

- When logging into your personal account, there is no “Accounting and reporting” branch in the workplace;

- When you enter the “Creation and presentation of reports” menu in the list

there is no authority (AU or BU); - There is no “Approve” button for documents with the statuses “Created with errors”, “Created without errors”.

Import

In the import guide you will find what to do if the following errors occur:

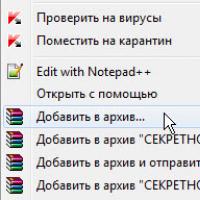

- The system gives errors when importing a report: “Document transformer not found”,

“Inconsistency in the number of fields in blocks TB=01, TB=02”; - The file does not load, and the system displays the message “Chapter code does not match”;

- It is not possible to load several reports on form 0503779 with different KFO –

checking for uniqueness interferes. When loading a new report with a different

The old KFO is cancelled.

Signing

The memo also describes what to do with signing documents in different situations:

- The system gives an error when signing the reporting form “This user

cannot approve the document";

in his absence? No reports have been created yet;- The user signing the reports goes on vacation. How to sign reports

in his absence? Reports have already been signed by one or more users.

Input and Editing

- The system gives an error when creating an entry in the “Settings” directory

approval of reporting forms.” When choosing a matching full name

the user is missing or repeated several times; - The “Counterparties” directory does not contain the required organization.

If in these lists you find an error that you encountered while working with GIIS Electronic Budget, see and download the memo with solutions to these problems in

Start working in the “Electronic Budget” or a local budget integrated with it information system sooner or later all state and municipal institutions will have to. The “federals” have already passed this stage and connected to this resource. However, at the regional and municipal level, not everyone is familiar with the connection procedure. What is the procedure?

As is known, federal government agencies must now be present in three subsystems of the “Electronic Budget”: budget planning, accounting and reporting, as well as procurement management - while most federal government agencies need to generate documents only in the first two components (if government agencies do not fall under the Federal Law of April 5, 2013 No. 44-FZ). The following documents are drawn up and signed electronically:

- agreements on the provision of subsidies (for the fulfillment of a state task, other purposes, capital investments);

- report (preliminary report) on the implementation of the state task;

- financial and economic activity plan;

- financial statements.

In turn, at the regional level, examples of the involvement of subordinate institutions in electronic document management are still few, and the lists of documents here are more modest (usually reports on the completion of tasks and plans for financial and economic activities are generated in information systems). This means that “on the ground” we have yet to master the algorithm for connecting and working with the “Electronic Budget”.

The connection process itself has repeatedly become a topic for clarification by the Ministry of Finance. The department addressed its letters first to government authorities, and subsequently to federal government agencies. These letters will also be useful to institutions at the regional (municipal) level.

|

For federal government bodies - Letter dated 04/08/2015 No. 21-03-04/19786. For authorities of constituent entities of the Russian Federation and municipalities - Letter dated 04/21/2015 No. 21-03-05/22801 |

||

|

Connection to the budget planning subsystem |

In terms of the formation and signing of agreements on the provision of subsidies, government tasks, as well as in terms of drawing up and approving a report on the implementation of state tasks - Letter dated November 16, 2015 No. 21-10-07/65901. Regarding the formation of a plan for financial and economic activities - Letter dated December 15, 2016 No. 21-03-04/75209 |

|

|

Connection to the accounting and reporting subsystem |

Letter dated December 12, 2016 No. 21-03-04/74236 |

|

|

Connection to the procurement management subsystem |

Letter dated June 17, 2016 No. 21-03-04/35490 |

|

All documents provide a general procedure for connecting to the Electronic Budget components. Necessary actions are detailed in Appendix 6 to Letter No. 21-03-04/19786 and in Letter No. 21-10-07/65901. Let's look at them.

Preparatory work in the institution.

Step 1- determine the person responsible for technical support for working with the components of the “Electronic Budget” and connecting users. This is done by issuing a document (letter, power of attorney, order) drawn up on the institution’s letterhead and signed by its head.

Step 2- issue a power of attorney to the person responsible for the technical support of the work to receive special funds cryptographic protection information that ensures the creation of a secure connection with information system components (CIPF), license keys and operational documentation for CIPF.

The power of attorney is drawn up on the letterhead of the organization, signed by its head and certified with the official seal. An approximate form of a power of attorney is given in Appendix 5 to Letter No. 21-03-04/19786.

Step 3- obtain qualified electronic signature verification key certificates for each future user of the information system. This is necessary to ensure legally valid electronic document management. The requirements for the form of a qualified certificate are approved by Order of the FSB of the Russian Federation dated December 27, 2011 No. 795.

The connection procedure directly involves the head of the institution, as well as the employee responsible for connecting users, and System Administrator(in practice this may be one person).

The certificate indicates the individual (certificate owner) acting on behalf of the legal entity on the basis of constituent documents or a power of attorney. The last name, first name, patronymic, SNILS and position of the employee contained in the certificate must match the same information in the application for connection to the information system.

Certificates used to work in the “Electronic Budget” can be obtained from any certification center that has the appropriate accreditation, including the certification center of the Federal Treasury (through its territorial body).

Step 4- obtain consent to the processing of personal data for each future user of the information system (a sample is given in Appendix 6 to Letter No. 21-03-04/19786). The consent must be personally signed by each employee of the institution who will work in the Electronic Budget.

Step 5- write an application for the issuance of CIPF. The application (its form is given in Appendix 4 to Letter No. 21-03-04/19786) must be drawn up on the letterhead of the organization and signed by its head (other authorized person). The number of license keys that need to be obtained is indicated here - it must be equal to the number of users connected to the “Electronic Budget”.

Step 6- distribute powers between future users of the “Electronic Budget”. Employees of the institution may be vested with the following powers:

- data entry (the employee can only create and edit generated documents);

- coordination;

- statement;

- viewing (an employee may be granted this authority, for example, in cases where a document is generated and approved by the founding body).

Package of documents.

Step 7- collect a package of documents and submit it to the Federal Treasury. This kit should include:

- order appointing someone responsible for technical support of the work (connection of users);

- power of attorney to receive cryptographic information information;

- application for obtaining CIPF, license keys and documentation for CIPF;

- consent to the processing of personal data of each connected user;

- a file of a valid qualified electronic signature verification key certificate for each connected user (on removable media).

Usually you also need to provide a separate blank removable media information on which distribution kits of special software and documentation for them.

The package of documents is submitted by the employee responsible for connecting users.

Step 8- obtain special software from the Federal Treasury, necessary to create a secure connection when entering and processing information at the workplaces of users of the information system. This should also be done by the employee responsible for connecting users.

Within three working days from the date of submission of the kit, the treasury authority checks the contents of the documents and makes a decision on granting access for each user. The corresponding notification is sent to the employee of the institution responsible for connecting users within two working days from the moment access is provided.

Preparation of automated workstations.

Step 9- ensure compliance of automated user workstations with the requirements listed in Appendix 6 to Letter No. 21-03-04/19786, including installing and setting up a cryptographic information protection tool. In particular, the requirements relate to hardware characteristics personal computers, operating systems that can be used, software that must be installed.

In addition, it is necessary to ensure the information security of each automated workstation from which access to the Electronic Budget components is provided. According to this application, protection of information from unauthorized access must be ensured at all stages of its processing.

Application for connection to the system.

Step 10- submit an application to connect to the “Electronic Budget” system. It is important that at this stage the procedure has changed. If in 2015 - 2016, authorities that connected to the system before institutions included such an application in the general package of documents sent to the Federal Treasury, now institutions are freed from this need.

The Ministry of Finance explained the application procedure for federal government agencies in Letter No. 21-10-07/65901. It says that applications for registration of heads of federal state institutions are prepared by the founding body and sent to the Ministry of Finance in the form of an electronic document in the information system. The heads of the federal state institution specified in the application for registration are connected to the “Electronic Budget” no later than three working days from the date the financial department receives this application - information about this is sent to the address specified in it Email.

Heads of institutions are automatically registered in the Electronic Budget system, so there is no need to submit connection applications for them.

As you can see, instead of a paper application, an electronic one is now submitted, and the heads of the Federal State Institutions themselves do not participate in this. The same applies to institutions at the regional (municipal) level. As the Ministry of Finance explained in Letter No. 21-03-04/75209, at present, the heads of budgetary and autonomous institutions included in the register of participants in the budget process, as well as legal entities who are not its participants are automatically granted the authority to generate registration applications. Information about the granting of such powers must be sent to the institution’s email address specified in the information of the said register. In other words, heads of institutions are automatically registered in the Electronic Budget system, so there is no need to submit applications for them.

Registration applications are required for other employees of institutions who will work in the information system. This authority is vested in the heads of institutions. Applications must be completed in the system itself (in the form of an electronic document) and signed with an enhanced qualified electronic signature of the head or person authorized to act on behalf of the institution.

Note that here you need to indicate the powers that are vested in this or that employee (data entry, approval, viewing). To do this, a check mark should be made in the box corresponding to the specific authority. In the future, each user must log into the system under a personalized certificate and perform actions in it based on the existing scope of rights.

The deadline for connecting employees is the same - three working days from the date of filing the registration application. Confirming information is sent to the email address specified in the registration application and the email address of the manager (other official authorized to submit applications).

Conclusion.

Connecting to the “Electronic Budget” is an organizational and technological process. It directly involves the head of the institution, as well as the employee responsible for connecting users, and the system administrator (in practice, this can be one person). In turn, there may be more users of the system: in addition to the manager, this group will include the deputy head of economic affairs, chief accountant, economist, procurement specialist and other employees. All of them must receive qualified electronic signature verification key certificates to work in the Electronic Budget.

After completing the above actions, the employees of the institution will only have to connect to the system and register in it (the qualified certificate of a particular employee will be “linked” to his account in the system, in addition, the user will be granted the necessary amount of rights specified in the connection application) and begin to work. Technological instructions for working with the system (including setting up workplaces), as well as user manuals for working in individual subsystems and modules, are posted on the official website of the Ministry of Finance.

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned

Order 343 mail. Order by Russian post. Consequences of failure to appear in court when summoned How to put a password on a folder on a Windows computer without and with programs

How to put a password on a folder on a Windows computer without and with programs Pluton – Free Bootstrap HTML5 One Page Template

Pluton – Free Bootstrap HTML5 One Page Template History of ZX Spectrum: Myths and reality New Spectrum

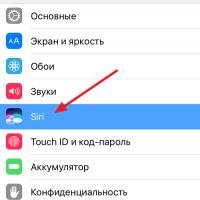

History of ZX Spectrum: Myths and reality New Spectrum Voice assistant Siri from Apple Siri functions on iPhone 6s

Voice assistant Siri from Apple Siri functions on iPhone 6s How to roll back to a previous version of iOS?

How to roll back to a previous version of iOS? Unlock iPad in four days

Unlock iPad in four days